For your

ALM system

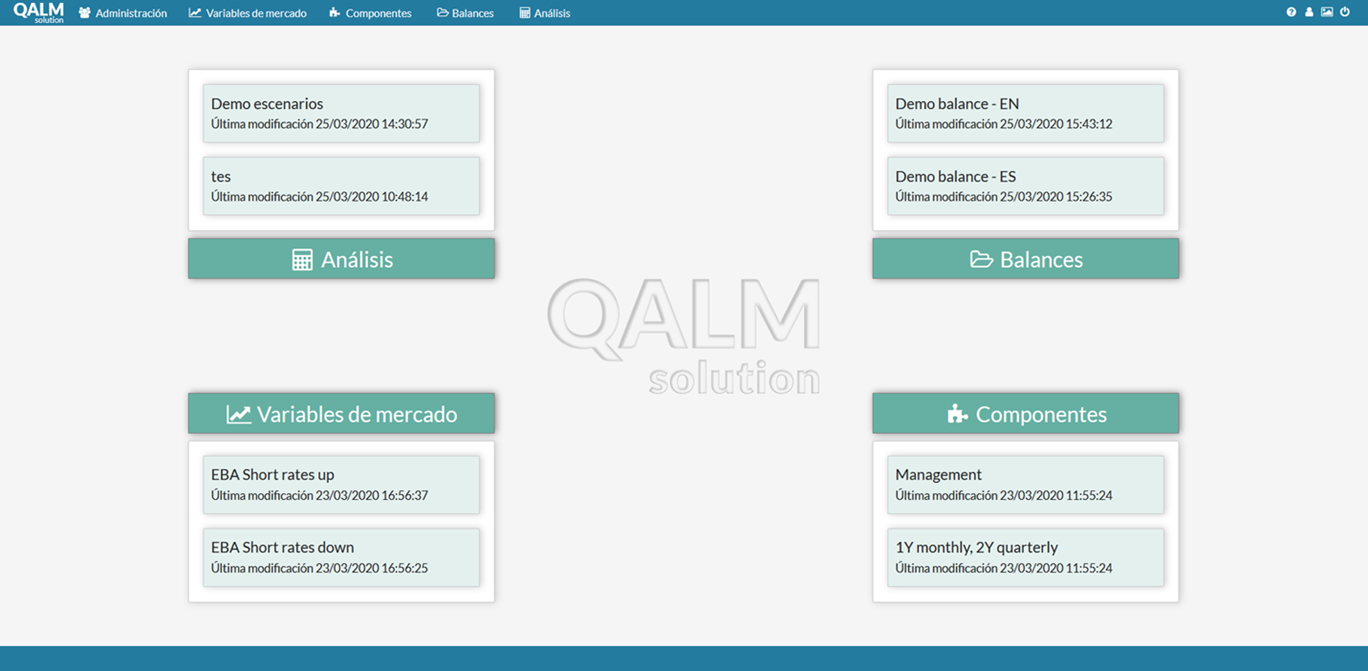

The QALM solution is at the heart of a comprehensive balance sheet risk management system

What is that tool?

Sum-up

Financial Institutions’ assets and liabilities Management Tool

Description

QALM is a comprehensive balance sheet risk management solution that encompasses interest rate risk and liquidity risk, among many other features. It is a complete ALM system, a common source for regulatory reporting and business management

Functionalities

ALM BUSINESS REPORTS

Some reports are available : 1/Indicators and cash flow profiles for interest rate and liquidity risk, 2/Modelling contractual asset & liability flows, 3/Value and duration

REGULATORY REPORTS

Execution of the required periodic regulatory reports (IRBB, LCR, VAR, …)

BUDGET PLANNING

For example : 1/ Liquidity and interest rate stress tests (regulatory and internal scenarios),

2/ Financial margin, 3/ Profitability

BEHAVIOURAL MODEL DEVELOPMENT

Non-contractual run-off modelling: (prepayments, demand deposits)

Tailored for business & value

30

times faster than our main competitors for the same technological environment

ANY

additional costs, QALM is designed to fit each financial institution, not the other way around

100%

visualization and updating for an optimal user experience

Manage your riks

Through QALM, measure and

manage the risk return

on the balance sheet

Start a free trial

Ask for a free and full access of QALM in our environnement and try it! For sure, our expert would

be there to support you in your journey

Request a demo

Speak one to one with a QUANT AI Lab expert

and get a tailored demo

of QALM!