ESG (Environment, Social and Governance) measurement emerges as one of the hot topic recently as the increasing interest to investment professionals globally. The assessment given by ESG rating provides information to market participants about the quality of a company’s ESG performance. Then, investors rely on this information to make investment decisions. In this trend, several companies recently have introduced rating service, as well as provided ESG score of certain firms. Our purpose is to clarify how ratings are determined by different providers, as well as the obstacle to achieving a reliable assessment.

ESG: An increasing interest to business investors

ESG (Environment, Social and Governance) is an analysis framework that provides an accurate assessment of the ESG performance of a given company. The overall score, following the three ESG pillars, is calculated through several indicators specified by each rating agency. Each company can have its own ESG assessment method to evaluate the evolution of its sustainability objectives.

The growing interest of ESG rating to asset management business has been shown by the flow into ESG-labeled investment products. For instance, Bank of America boosts its ESG financing goal — up to $1 trillion by 2030. “Beyond the $1 trillion climate-related finance, the balance of the sustainable finance goal is focused on social inclusive development, scaling capital to advance community development, affordable housing, healthcare, and education, in addition to racial and gender equality”, according to a report of Kelly Sapp, Bank of America in April 2021. Also, numerous central banks in OECD (Paris-based Organization for Economic Co-operation and Development) countries started integrating ESG assessments into their investment approaches as a tool to better align their portfolios with a transition to climate-resilient, low-carbon economies.

In the trend that ESG investing growing exponentially, how is the measurement of ESG performance developed so far? Is there a certain methodology presented?

Current ESG rating methodologies

ESG rating agencies measure the positive or negative impact of a company on the environment, society and/or governance in order to allow investors, stakeholders and consumers to be informed about the sustainability of the company’s projects. As of today, various notation agencies developed their own commercial ESG rating services (e.g. MSCI, S&P, Thomson Reuters, ISS…).

The overall ESG performance score of the company is expressed in different ways depending on the rating agencies. Some rating agencies use letters, such as MSCI (seven-point scale from the worst CCC to the best AAA), ISS (D to A), others score on a percentile basis by a scale of 1 to 100, such as Thomson Reuters, S & P Global CSA.

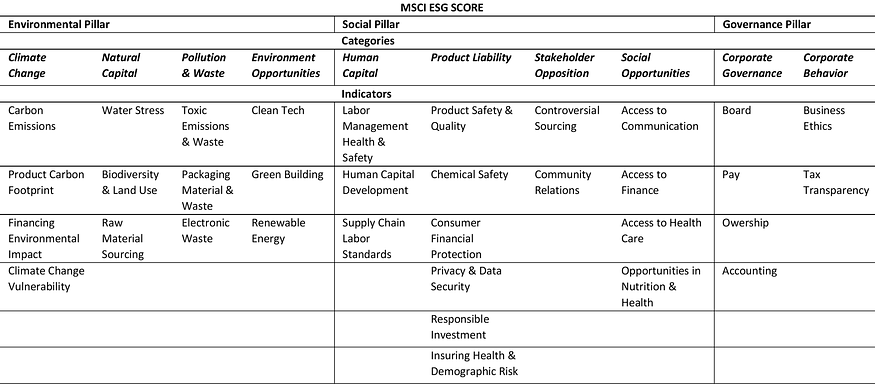

In order to get an overall ESG score, rating agencies typically assess separately each ESG pillar (E, S, G) before aggregation to compute the final overall score. Each pillar is evaluated according to several criteria grouped into several categories. Here below is an example of MSCI’s ESG frameworks:

In the next stage, the rating providers have to screen major factors contributing to each category. This could be done by statistical analysis of historical data or be hypothesized by considering the theoretical relations that are not tested. Rating agencies can refer to reporting framework provided by third-party organizations, such as Global Reporting Initiative, Sustainability Accounting Standards Board, Task Force on Climate-Related Financial Disclosures… that have similar proprietary frameworks. Although the overall goals are similar, their ratings show quite different stories about sustainability credentials of companies, due to the differences between their approaches, as reviewed by Sipiczki A. on CEPS Policy Insights, 2022. MSCI aggregates the weighted average of the key issue score to calculate firms ESG score.

Focus on S&P methodology:

S&P gives ESG score on a scale of 0–100. Points are awarded at the question-level. These questions’ levels are then progressively weighted and summed at the Criteria- and Dimension-levels to create a final aggregated S&P Global ESG Score, as summed up in the formula below:

SPESG = Σ (((SPQP * SPQW) * SPCW) * SPDW)

(SPESG = S&P Global ESG Score

SPQP = Question Points

SPQW = Question Weight

SPCW = Criteria Weight

SPDW = Dimension Weight)

Focus on Thomson Reuters methodology:

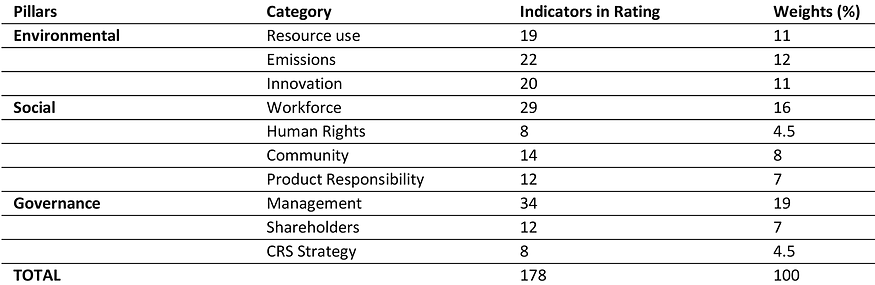

Thomson Reuters measures a company’s ESG performance by considering public reported data. It captures and calculates 178 most relevant fields to the overall company scoring process. These indicators are grouped into 10 categories. The overall score is calculated by a combination of these 10 categories weighted proportionately to the count of measures within each category.

Detailed counts and weights are listed in the table below:

The conversion from a percentile score to a letter grade is based on a framework to get the final rating in the grade scale from the worst D- to the best A+.

Thus, ESG rating providers gather public information to grade companies and sort them into ESG indexes. Investors and financial advisers, in turn, rely on ratings and indexes to put their money in companies that fit their needs.

Challenges of measuring a concept as broad and all-encompassing as ESG

While ESG rating providers may convey important insights into the nonfinancial impact of companies, significant shortcomings exist in their methodologies, which undermine the informativeness of their assessments.

The challenges observed in ESG rating could be:

· A lack of quantifiable information

· A high cost of gathering information

· A lack of comparability across firms

· Absence of regulations aiming to standardize the ESG ratings

In order to assess three pillars at the same time, the great demand for ESG information comes from varieties stakeholders, companies, investors, and regulators making consequently the number of indicators — considered in the ESG assessment — very large and different from one rating agency to another. For instance, “FTSE Russell claims its model uses 300 indicators. Refinitiv uses 630 ESG metrics. S&P Global uses 1,000 underlying data points”, reported by Larcker D. F. et al., 2018.

Most information dedicated to ESG rankings is sourced from:

· Companies’ voluntary disclosures that might be unaudited

· Their responses provided to rating agencies’ questionnaires/ surveys

· Unstructured company data (e.g. media reports, non-governmental organization reports)

· Third-party data.

Therefore, gathering the information and preparing it for use in analysis is extremely costly.

The lack of harmonization of ESG indicators and their respective weights among rating agencies presents another challenge. Without a homogenization of the different rating methods, the ESG score will remain, in a large majority of cases, a relatively arbitrary rating. That makes the current ESG scores not relevent enough. And, unfortunately, the convergence of rating methods remains a difficult objective to achieve, and there is no glimmer of hope on the horizon so far. For example, according to a study on analysis of the correlation between the rating of different agencies (MSCI, S&P, Sustainalytics, CDP, ISS, Bloomberg), the correlated performance ranges from 7 % (between ISS and CDP) and 74 % (between S&P and Bloomberg).

The lack of comprehensive reporting standards are leading rating agencies to fill data gaps by self-reported data, relying on the opinion of industry members, making assumptions, or collecting missing information through third-party sources such as utility providers. The latter worsens even more the subjectivity and reliability of the scoring process (Berg, Kölbel and Rigobon, 2020). Given that rating companies based on ESG metrics has not yet been regulated by authorities. ESG disclosures tend to be more subjective than financial reports.

Despite these concerns, ESG ratings providers’ services are in high demand. And for a good reason, as investors struggle to find and compare “decision-useful” ESG disclosures, ESG ratings providers contrive to bridge the information gap.

Conclusion

The term ESG first emerged in 2004 in a study titled “Who cares Wins”. Over the years, the relationship between ESG and investing has grown stronger throughout the world. The future of finance goes hand in hand with social responsibility, environmental stewardship and corporate ethics is the trend for businesses leaders.

Investors are looking for consistent, comparable, and decision-useful disclosures to develop investment strategies. Yet the rating attributed by the rating agencies to companies remains different and inconsistent that might cause confusion to investors, who rely on this information to really know how well a company is performing. Hence, the current method of labelling ESG score is not reliable enough. In a recent study of Larcker et al., 2022, the authors suggested a combination of rating by multiple providers to reduce the “noise” from conflicting assessments. Furthermore, data quality is one of the key parts of the assessment process. Thus, another perspective may be a combination of NLP and human processes. This perspective could help to maximize the quality of data and make it free from subjectivity as well.